UNITED STATES

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant | |

| |

Filed by a Party other than the Registrant | |

| |

Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

UNIQURE N.V. | |||

(Name of Registrant as Specified | |||

| |||

| |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| |||

Payment of Filing Fee (Check the appropriate box): | |||

| No fee required. | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

| Fee paid previously with preliminary materials. | ||

|

| ||

|

| ||

|

| ||

|

| ||

|

| ||

uniQure N.V.

Paasheuvelweg 25a

1105BP1105 BP Amsterdam

The Netherlands

+1-339-970-7000

April 30, 2018

Dear Shareholder:

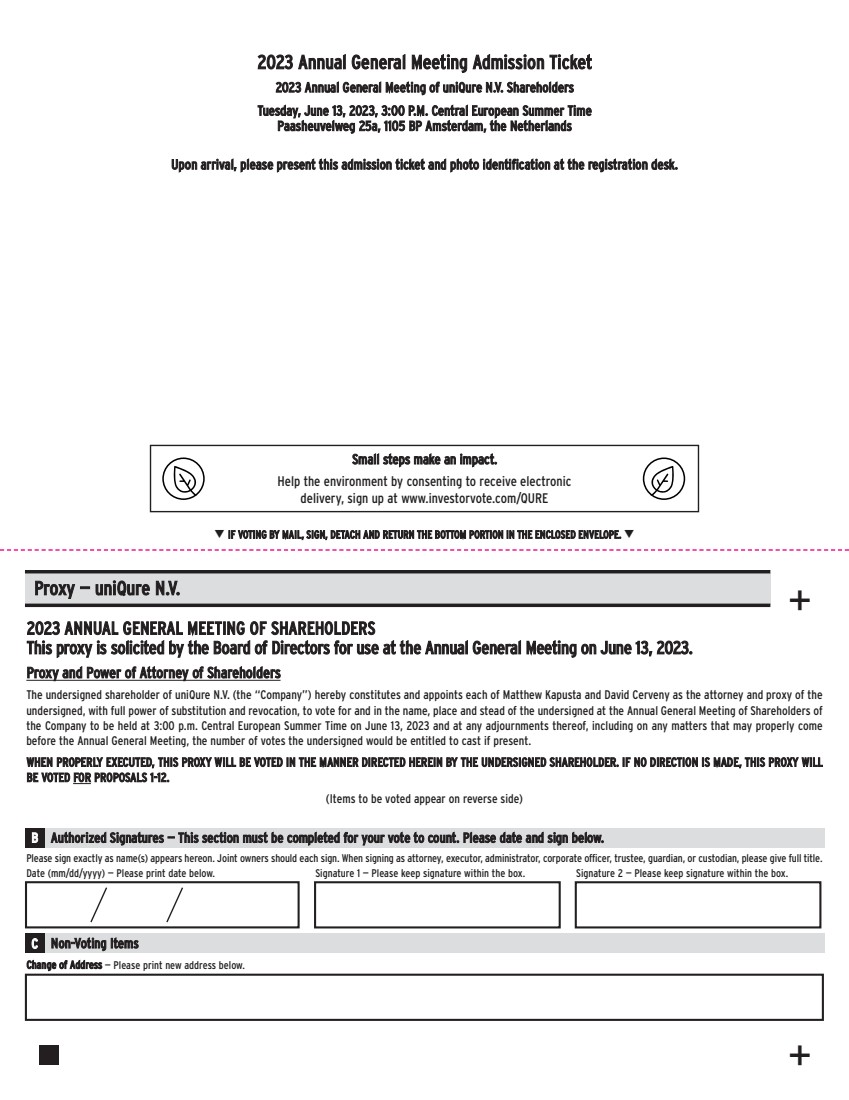

On behalf of the Board of Directors of uniQure N.V. (the “Company”), I invite you to attend our 20182023 Annual General Meeting of Shareholders on June 13, 2023, at 3:00 p.m., Central European Summer Time (the “2018“2023 Annual Meeting”). The 20182023 Annual Meeting will be held on June 13, 2018, at 9:30 a.m., Central European Summer Time at the Company’s principal executive offices located at Paasheuvelweg 25a, 1105BP1105 BP Amsterdam, the Netherlands.

The matters to be voted upon at the 20182023 Annual Meeting are listed in the Notice of the 2018 Annual General Meeting of Shareholders (the “Notice”) and are more fully described in the proxy statement accompanying this letter (the “Proxy Statement”).

AtRegistered Shareholders (as defined in the 2018“Notice of Annual General Meeting you will be provided an opportunityof Shareholders” below) are entitled to asksubmit their questions regarding the matters to be voted upon, gain an up-to-date perspective on the Company and its activities, and meet the directorsagenda items ahead of the Company.2023 Annual Meeting by email to investors@uniQure.com and during the 2023 Annual Meeting, in each case, as more particularly described in the Proxy Statement.

We have opted to provide our materials pursuant touse the full set delivery option in connection with“Notice and Access” method of posting the 2018 Annual Meeting. Under the full set delivery option, a company delivers all proxy materials online instead of mailing printed copies. We believe that this process will provide you with a convenient and quick way to its shareholders. Accordingly, you should have received ouraccess the proxy materials, by mail or, if you previously agreed, by e-mail. These proxy materials includeincluding this Notice of Annual Meeting of Shareholders, Proxy Statement proxy card and theour Annual Report on Form 10-K.10-K for the year ended December 31, 2022, and to authorize a proxy to vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials.

Shareholders will not receive paper copies of the proxy materials unless they request them. Instead, the Notice, which will be mailed to our Shareholders of record, provides instructions regarding how you may access or request all of the proxy materials by telephone or email. The Notice also instructs you how to vote your shares online. If you prefer to receive a paper or email copy of the proxy materials, you should follow the instructions for requesting such materials printed on the Notice. These materials are available free of charge at http://www.edocumentview.com/QURE and, if you are a registered holder, you may vote at http://www.investorvote.com/QURE.QURE. Further instructions for accessing thethese proxy materials and voting at the 2023 Annual Meeting are described in the Notice of the 2018 Annual Meeting and the Proxy Statement.

Your vote is very important. Whether or not you plan to attend the meeting,2023 Annual Meeting in person, please carefully review the enclosed proxy statementProxy Statement and then cast your vote, regardless of the number of shares you hold. If you are a shareholder of record, you may vote over the Internet, by telephone or by completing, signing, dating, and mailing the accompanying proxy card in the return envelope.envelope no later than 11:59 p.m. Central European Summer Time on June 12, 2023. If mailingyou mail the proxy card within the United States, no additional postage is required. Submitting your vote via the Internet or by telephone or proxy card will not affect your right to vote in person if you decide to attend the 20182023 Annual Meeting in person, provided that you have notified the Company of your intention to attend the meeting no later than 12:00 p.m. Central European Summer Time on June 11, 2018.12, 2023. If your shares are held in street name (held for your account by a broker or other nominee), you will receive instructions from your broker or other nominee explaining how to vote your shares and you will have the option to cast your vote by telephone or overin the Internet if yourmanner provided in the voting instruction forminstructions you receive from your broker or nominee includes instructions and a toll-free telephone number or Internet website to do so.other nominee. In any event, to be sure that your vote will be received in time (and no later than 11:59 p.m. Central European Summer Time on June 12, 2023), please cast your vote by your choice of available means at your earliest convenience.

Thank you for your continuing interest in the Company. We look forward to seeing you atattending the 20182023 Annual Meeting.

If you have any questions about the Proxy Statement, please contact investor relations at investors@uniQure.com.

| Sincerely, |

|

|

|

|

| /s/ Matthew Kapusta |

|

| Matthew Kapusta |

|

| Chief Executive Officer |

|

uniQure N.V.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

June 13, 20182023

To the Shareholders of uniQure N.V.:

Notice is hereby given that the 20182023 Annual General Meeting of Shareholders (the “2018“2023 Annual Meeting”) of uniQure N.V., a public company with limited liability (naamloze vennootschap) under the laws of the Netherlands (the “Company,”, “uniQure,” andor “we”), will be held on June 13, 2018,2023, at 9:30 a.m.3:00 p.m., Central European Summer Time, at the Company’s principal executive offices located at Paasheuvelweg 25a, 1105BP1105 BP Amsterdam, the Netherlands for the following purposes:

I. | Opening and announcements | |

II. | Board Report on the financial year | |

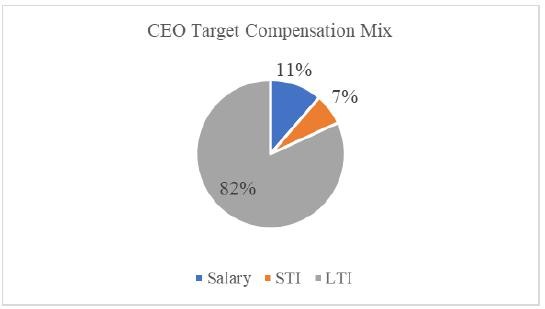

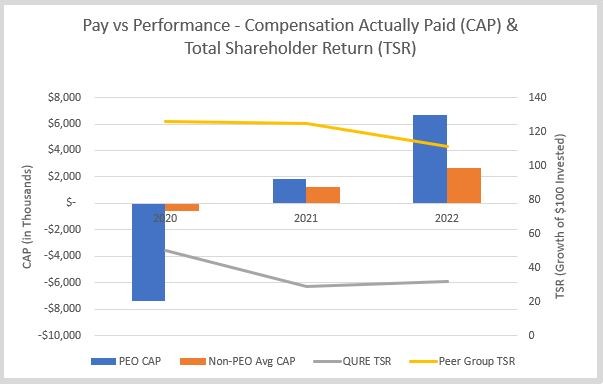

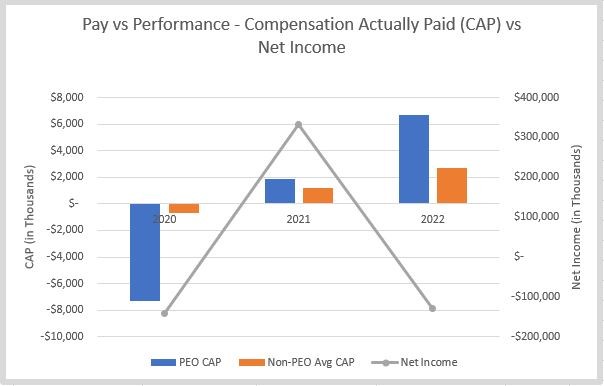

III. | Explanation of the application of the remuneration policy (for discussion only) | |

IV. | Adoption of the | |

V. | Discharge of liability of the members of the Board of Directors | |

VI. | Board | |

a) | ||

b) c) reappointment of Leonard Post as non-executive director (Voting Proposal No. 5) d) reappointment of Jeremy Springhorn as non-executive director (Voting Proposal No. 6) | ||

VII. |

| |

|

| |

|

| |

| Renew the designation of the Board as the competent body to issue Ordinary Shares and | |

VIII. | Reauthorize the Board to exclude or | |

| IX. | Reauthorize the Board to repurchase Ordinary Shares |

|

| |

| To approve, on an advisory basis, the compensation of the named executive officers of the Company (Voting Proposal No. 11) | |

XII. | To approve the amendment and restatement of the Company’s 2014 Share Incentive Plan (Voting Proposal No. 12) | |

XIII. | Any other business | |

XIV. | Closing of the meeting |

Our Board of Directors (our “Board”) recommends that you vote “FOR”“FOR” each of the voting proposals noted above.

A numberSeveral of the agenda items are presented to the 20182023 Annual Meeting as a result ofbecause our Company beingis organized under the laws of the Netherlands. Several matters that are within the authority of the Board under the corporate laws of most U.S. states require shareholder approval under Dutch law. Additionally, Dutch corporate governance provisions require certain discussion topics for an annual general meeting of shareholders upon which shareholders do not vote.

The Board has fixed the close of business EasternCentral European Summer Time on May 16, 20182023 as the record date and, therefore, only the Company’s shareholders of record (“Registered Shareholders”) at the close of business EasternCentral European Summer Time on May 16, 20182023 are entitled to receive this notice (this(the “Notice”) and to vote at the 20182023 Annual Meeting and any adjournment thereof.

Only shareholdersRegistered Shareholders who have given notice in writing to the Company by 12:00 p.m. Central European Summer Time on June 11, 201812, 2023 of their intention to attend the 20182023 Annual Meeting in person are entitled to so attend the 20182023 Annual Meeting in person.Meeting. The conditions for attendance at the 20182023 Annual Meeting are as follows:

| o | Registered Shareholders must (i) notify the Company by 12:00 p.m. Central European Summer Time on June 12, 2023 of their intention to attend the 2023 Annual Meeting by submitting their name and the number of registered shares held by them through the Company’s email address at investors@uniQure.com and (ii) bring a form of personal picture identification to the 2023 Annual Meeting; and |

2. Holders of shares held in street name (“Beneficial Holders”) must have their financial intermediary, agent or broker with whom the shares are on deposit issue a proxy to them which confirms they are authorized to take part in and vote at the 2018 Annual Meeting. These Beneficial Holders must (i) notify the Company of their intention to attend the 2018 Annual Meeting by submitting their name and the number of shares beneficially owned by them through the Company’s email address at investors@uniQure.com no later than June 11, 2018, (ii) bring an account statement or a letter from the record holder indicating that you owned the shares as of the record date to the 2018 Annual Meeting, (iii) bring the proxy issued to them by their financial intermediary to the 2018 Annual Meeting and (iv) bring a form of personal picture identification to the 2018 Annual Meeting.

| o | Holders of shares held in street name (“Beneficial Holders”) must have their financial intermediary, agent or broker with whom the shares are on deposit issue a proxy to them that confirms they are authorized to take part in and vote at the 2023 Annual Meeting. These Beneficial Holders must (i) notify the Company of their intention to attend the 2023 Annual Meeting by submitting their name and the number of shares beneficially owned by them through the Company’s email address at investors@uniQure.com no later than 12:00 p.m. Central European Time on June 12, 2023, (ii) bring an account statement or a letter from the record holder indicating that the Beneficial Holder owned the shares as of the record date to the 2023 Annual Meeting, (iii) bring the proxy issued to them by their financial intermediary to the 2023 Annual Meeting and (iv) bring a form of personal picture identification to the 2023 Annual Meeting. |

A proxy statement more fully describing the matters to be considered at the 20182023 Annual Meeting (the “Proxy Statement”) is attached to this Notice. Copies of our Annual Report on Form 10-K for the year ended December 31, 20172022 (the “Annual Report on Form 10-K”), including our financial statements and notes thereto, as filed with the U.S. Securities and Exchange Commission, accompany this Notice, but are not deemed to be part of the Proxy Statement.

We have opted to provide our materials pursuant touse the full set delivery option in connection with“Notice and Access” method of posting the 2018 Annual Meeting. Under the full set delivery option, a company delivers all proxy materials online instead of mailing printed copies. We believe that this process will provide you with a more convenient and quicker way to its shareholders. This delivery can be by mail or, if a shareholder has previously agreed, by e-mail. In addition to deliveringaccess the proxy materials, and to shareholders,authorize a company must also post allproxy to vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials.

Registered Shareholders will not receive paper copies of the proxy materials unless they request them. Instead, this Notice, which has been (or will be) mailed to our Registered Shareholders, provides instructions regarding how you may access or request all of the proxy materials by telephone or email. This Notice also instructs you how to vote your shares online. If you prefer to receive a paper or email copy of the proxy materials, you should follow the instructions for requesting such materials printed herein. All proxy materials are on a publicly accessible website and provide information to stockholders about how to access that website. Accordingly, you should have received our proxy materials by mail or, if you previously agreed, by e-mail. These proxy materials include this Notice of Annual Meeting of Shareholders, Proxy Statement, proxy card and the Annual Report on Form 10-K. These materials are available free of charge at http://www.edocumentview.com/QURE.QURE.

Our 20172022 Dutch statutory annual accountsStatutory Annual Accounts and our 2022 Dutch Statutory Board Report are available on our website at www.uniqure.com. www.uniqure.com.

If you do not plan on attending the 2018The 2023 Annual Meeting is an important event in our corporate calendar and ifprovides an opportunity to engage with shareholders and for shareholders to pass the necessary resolutions for the conduct of the business and affairs of the Company.

Whether or not you are a Registered Shareholder,plan to attend the 2023 Annual Meeting in person, please vote via the Internet or, if you are a Beneficial Holder, please submitprior to the voting instruction form you receive from your broker or nominee as soon as possible so your shares can be voted at the meeting.2023 Annual Meeting. You may submit your voting instruction form by mail. If you are a Registered Shareholder, you also may vote by telephone or by submitting a proxy card by mail.mail prior to the 2023 Annual Meeting. If youyour shares are a Beneficial Holder,held in street name, you will receive instructions from your broker or other nominee explaining how to vote your shares, and you also may have the choice of instructing the record holder as to the voting of your shares by proxy, over the Internet or by telephone. Follow the instructions on the voting instruction form you receive from your broker or other nominee. YouIf you are submitting a proxy card by mail, you do not need to affix postage to the enclosed reply envelope if you mail it within the United States. If you attend the meeting, you may withdraw your proxy and vote your shares personally.

All proxies submitted to us will be tabulated by Computershare. All shares voted by Registered Shareholders present in person at the 2018 Annual Meeting will be tabulated by the secretary designated by the chairman of the 2018 Annual Meeting.

All shareholdersShareholders are extended an invitation to attend the 20182023 Annual Meeting.

| By Order of the Board of Directors, |

|

|

|

|

| /s/ Matthew Kapusta |

|

| Matthew Kapusta |

|

| Chief Executive Officer |

|

|

Important Notice Regarding the Availability of Proxy Materials for the Shareholder2023 Annual General Meeting Toof

Shareholders to Be Held on June 13, 20182023

The Proxy Statement, Proxy Card, and our 2017 Annual Report on Form 10-K are available at

http://www.edocumentview.com/QURE

and, together with theour 2022 Dutch 2017 annual statutory accounts,Statutory Annual Accounts and our 2022 Dutch Statutory Board Report, on our website at http://www.uniqure.com.

TABLE OF CONTENTS

| | |

1. | 1 | |

| | |

2. | PROXY STATEMENT FOR THE 2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS | 2 |

| | |

3. | 2 | |

| | |

4. | 8 | |

| | |

5. | AGENDA ITEM V - VOTING PROPOSAL NO. 2 - DISCHARGE OF LIABILITY FOR THE MEMBERS OF THE BOARD | 9 |

| | |

6. | AGENDA ITEM VI - VOTING PROPOSAL NO. 3, NO. 4, NO. 5, AND NO. 6- BOARD APPOINTMENTS | 10 |

| | |

7. | 13 | |

| | |

8. | 15 | |

| | |

9. | AGENDA ITEM IX - VOTING PROPOSAL NO. 9 - REAUTHORIZE THE BOARD TO REPURCHASE ORDINARY SHARES | 16 |

| | |

10. | 17 | |

| | |

11. | 18 | |

| | |

12. | 20 | |

| | |

13. | 21 | |

| | |

14. | 32 | |

| | |

15. | 43 | |

| | |

16. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 45 |

| | |

17. | 48 | |

| | |

18. | 49 | |

| | |

19. | 69 | |

| | |

20. | 70 | |

| | |

21. | 72 | |

| | |

22. | 74 | |

| | |

23. | 85 | |

| | |

24. | 86 | |

| | |

25. | 87 | |

| | |

26. | 89 |

1. | 6 | |

|

|

|

2. | PROXY STATEMENT FOR THE 2018 ANNUAL GENERAL MEETING OF SHAREHOLDERS | 7 |

|

|

|

3. | 12 | |

|

|

|

4. | 12 | |

|

|

|

5. | AGENDA ITEM III —EXPLANATION OF THE APPLICATION OF THE REMUNERATION POLICY | 12 |

|

|

|

6. | 12 | |

|

|

|

7. | AGENDA ITEM V VOTING PROPOSAL NO. 2— DISCHARGE OF THE MEMBERS OF THE BOARD | 13 |

|

|

|

8. | AGENDA ITEM VI VOTING PROPOSAL NO. 3 and NO. 4 — BOARD APPOINTMENTS | 13 |

|

|

|

9. | AGENDA ITEM VII VOTING PROPOSAL NO. 5 — AMENDMENT OF THE 2014 RESTATED PLAN | 15 |

|

|

|

10. | 21 | |

|

|

|

11. | AGENDA ITEM IX VOTING PROPOSAL NO. 7 — APPROVAL OF EMPLOYEE SHARE PURCHASE PLAN | 21 |

|

|

|

12. | 26 | |

|

|

|

13. | AGENDA ITEM XI VOTING PROPOSAL NO. 9—REAUTHORIZATION OF THE BOARD TO REPURCHASE ORDINARY SHARES | 27 |

|

|

|

14. | 29 | |

|

|

|

15. | 30 | |

|

|

|

16. | 31 | |

|

|

|

17. | 31 | |

|

|

|

18. | 32 | |

|

|

|

19. | 40 | |

|

|

|

20. | 41 | |

|

|

|

21. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 43 |

|

|

|

22. | 47 | |

|

|

|

23. | 48 | |

|

|

|

24. | 53 | |

|

|

|

25. | 53 | |

|

|

|

26. | 55 | |

|

|

|

27. | 61 | |

|

|

|

28. | 61 | |

|

|

|

29. | 63 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in the following proxy statementProxy Statement for the 20182023 Annual General Meeting of Shareholders are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended or the Exchange Act,(the “Exchange Act”), and are subject to the safe harbor created by those sections.

Forward-looking statements are based on our current assumptions, projections and expectations of future events, and are generally identified by words such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions, or the negatives thereof, or future dates. Forward-looking statements involveare subject to risks and uncertainties that could cause actual results to differ materially from those projected or implied. The most significant factors known to us that could materially adversely affect our business, operations, industry, financial position or future financial performance are described in “Part I, Item 1A, Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission or SEC,(the “SEC”) on March 14, 2018, in “Part I, Item 1A, Risk Factors,” which is being provided to you together with this proxy statement. February 27, 2023 (the “Annual Report on Form 10-K”).

You should not place undue reliance on any forward-looking statement, which speaks only as of the date made, and should recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results due to the risks and uncertainties described in our Annual Report on Form 10-K, including in “Part I, Item 1A. Risk Factors,” as well as others that we may consider immaterial or do not anticipate at this time. The risks and uncertainties described in our Annual Report on Form 10-K are not exclusive and further information concerning our company and our businesses,business, including factors that potentially could materially affect our operating results or financial condition, may emerge from time to time. We undertake no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. We advise you, however, to consult any further disclosures we make on related subjects in our future Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that we file with or furnish to the SEC.

1

uniQure N.V.

Paasheuvelweg 25a

1105 BP Amsterdam

The Netherlands

+1-339-970-7000

uniQure N.V.

Paasheuvelweg 25a

1105BP Amsterdam

The Netherlands

+1-339-970-7000

PROXY STATEMENT FOR THE 20182023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on June 13, 20182023, at 9:30 a.m.3:00 p.m., Central European Summer Time

This proxy statement (the “Proxy Statement”), which includes the explanatory notes to the agenda for the 20182023 Annual General Meeting of Shareholders (the “2018“2023 Annual Meeting”), and the accompanying proxy card, (the “Proxy Card”), are being furnished with respect to the solicitation of proxies by the Board of Directors (the “Board”) of uniQure N.V., a public company with limited liability (naamloze vennootschap) under the laws of the Netherlands (the “Company,” “uniQure”“uniQure,” “our” or “we”), for the 20182023 Annual Meeting. The 20182023 Annual Meeting will be held at 9:30 a.m.3:00 p.m. Central European Summer Time on June 13, 2018,2023, and at any adjournment thereof, at the Company’s principal executive offices located at Paasheuvelweg 25a, 1105BP1105 BP Amsterdam, the Netherlands.

The approximate date on which the Notice of Internet Availability of Proxy Statement and Proxy Card are intended to beMaterials is first being sent or given to the Company’s shareholders (each a “Shareholder”, and collectively, the “Shareholders”) is May 16, 2018.17, 2023.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL GENERAL MEETING

Why did I receive these proxy materials?

The purposes

We are providing these proxy materials to you in connection with the solicitation by our Board of proxies to be voted at the 2018 Annual Meeting are to discussMeeting.

What am I Voting on and voteHow Does the Board Recommend I Vote?

You will be voting on the following:

following proposals. After careful consideration, the Board unanimously recommends that the Registered Shareholders vote as follows:

|

|

|

|

|

|

| (2) | Voting Proposal No. 2: “FOR” discharge of | |

|

| |

|

|

| (3) | Voting Proposal No. 3: “FOR” reappointment of | |

|

| |

|

| Voting Proposal No. 4: “FOR” reappointment of |

|

| Voting Proposal No. 5: “FOR” reappointment of Leonard Post as non-executive director. |

|

| Voting Proposal No. 6: “FOR” reappointment of Jeremy Springhorn as |

|

|

|

|

| (8) | Voting Proposal No. 8: “FOR” reauthorizing the Board to exclude or |

|

| Voting Proposal No. 9: “FOR” reauthorization of the Board to repurchase Ordinary |

2

|

| Voting Proposal No. 10: “FOR” appointment of |

|

|

|

|

| (12) | Voting Proposal No. 12: “FOR” the amendment and restate of the Company’s 2014 Share Incentive Plan. |

Who May Vote at the 2023 Annual Meeting?

ShareholdersIf you are a holder of record of our ordinary shares (the “Ordinary Shares”) as ofor if you hold Ordinary Shares in street name at the close of business Eastern Time on May 16, 20182023 (the “Record Date”) you are entitled to receive notice of and to vote at the 20182023 Annual Meeting and any adjournment thereof. On March 31, 2018,We expect that we had issued andwill have approximately 46,968,032 Ordinary Shares outstanding 31,771,816 Ordinary Shares.as of the Record Date. We have no other securities entitled to vote at the 20182023 Annual Meeting. Each Ordinary Share is entitled to one vote on each matter.voting proposal. There is no cumulative voting.

What Vote is Required?

A listUnder the Company’s Articles of Shareholders entitled to voteAssociation, the presence at the 20182023 Annual Meeting will be available at the 2018 Annual Meeting and will also be available for ten (10) days prior to the 2018 Annual Meeting, during regular office hours, at the principal executive officesof one-third of the Company, located at Paasheuvelweg 25a, 1105BP Amsterdam, the Netherlands,issued share capital, present in person or represented by contacting investor relations.

proxy, is required for a quorum.

Each matter proposed by the Board, other than with respect to the reappointment of directors (voting proposals Nos. 3-6) and the reauthorization of the Board to exclude or limit preemptive rights upon the issuance of Ordinary Shares and granting of rights to subscribe for Ordinary Shares (voting proposal No. 8), shall be adopted by a simple majority of the votes cast at the 20182023 Annual Meeting. UnderAbstentions, “blank votes”, “broker non-votes” and invalid votes are not considered votes cast.

Voting Proposals Nos. 3-6: under the Company’s Articles of Association and consistent with Dutch law, executive directors and non-executive directors are appointed by the Nasdaq rules,general meeting from a binding nomination by the presencenon-executive directors. The proposed candidate specified in the binding nomination shall be appointed, provided that the requisite quorum is present or represented at the 2018general meeting, unless the nomination is overruled by the general meeting (which resolution requires a majority of at least two-thirds of the votes cast, provided that such majority represents more than half of the issued share capital), in which case he or she will not be appointed.

Voting Proposal No. 8: pursuant to the Company’s Articles of Association, if less than half of the issued capital is represented, the proposal reauthorizing the Board to exclude or limit preemptive rights upon the issuance of Ordinary Shares and granting of rights to subscribe for Ordinary Shares can only be adopted by a majority of at least two-thirds of the votes cast. If more than of the issued capital is represented, a simple majority is sufficient to adopt this proposal.

What is the Difference Between Being a Holder of Record of Ordinary Shares and Holding Ordinary Shares in “Street Name”?

A holder of record holds Ordinary Shares in his or her name. Ordinary Shares held in “street name” means Ordinary Shares that are held in the name of a bank or broker on a person’s behalf.

3

Am I Entitled to Vote if My Ordinary Shares are Held in “Street Name”?

Yes. If your Ordinary Shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those Ordinary Shares held in “street name.” If your Ordinary Shares are held in street name, these proxy materials will be provided to you by your bank or brokerage firm, along with a voting instruction card. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions.

How Can I Vote My Ordinary Shares?

If you are a record holder of Ordinary Shares at the close of business on the Record Date, you may vote as follows:

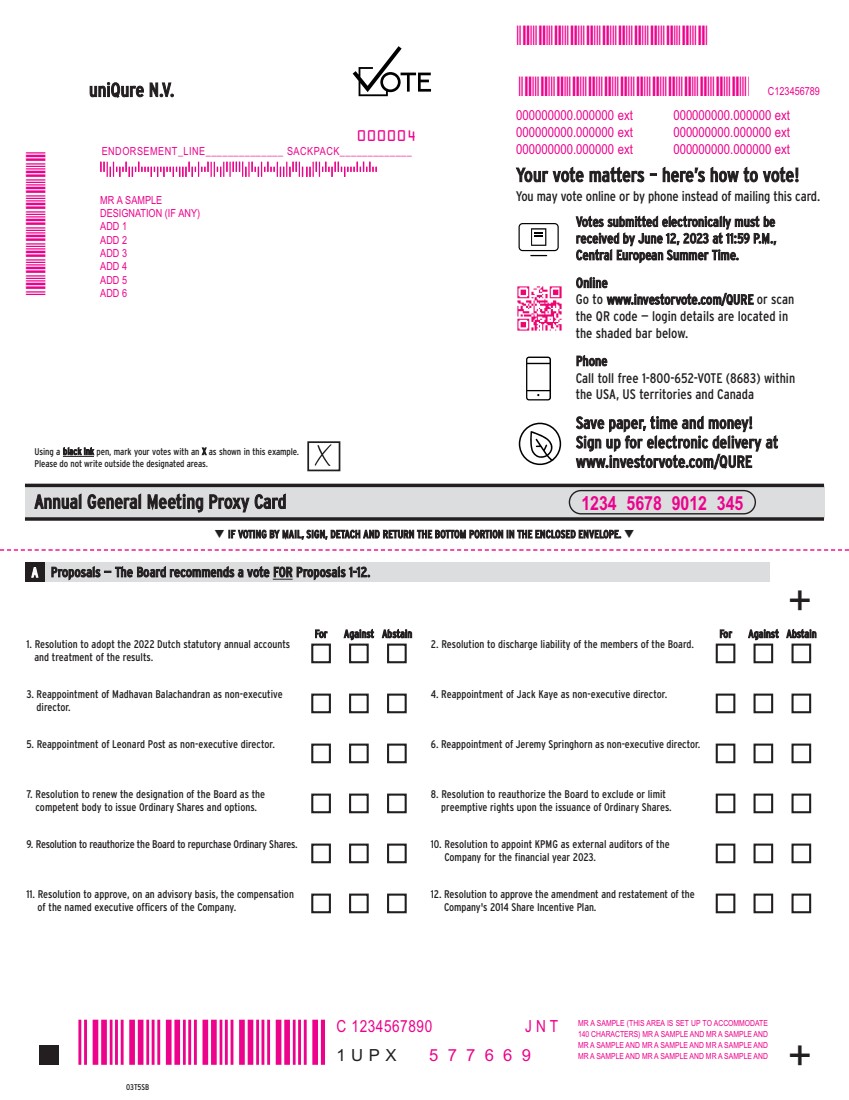

| ● | By Internet. Access the website of the Company’s tabulator, Computershare, at: http://www.investorvote.com/QURE,using the voter control number printed on the furnished proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your Internet vote cannot be completed, and you will receive an error message. If you vote on the Internet, you also may request electronic delivery of future proxy materials. |

| ● | By Telephone. Call 1-800-652-8683 toll-free from the U.S., U.S. territories and Canada and follow the instructions on the enclosed proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your telephone vote cannot be completed. You must have the control number that is included on the proxy card when voting. |

| ● | By Mail. If you receive a proxy card by mail, complete and mail a proxy card in the enclosed postage prepaid envelope to the address provided. Your shares will be voted in accordance with your instructions. If you are mailed or otherwise receive or obtain a proxy card, and you choose to vote by telephone or by Internet, you do not have to return your proxy card. |

| ● | In Person at the Meeting. If you attend the 2023 Annual Meeting, be sure you have given notice in writing to the Company by 12:00 p.m. Central European Summer Time on June 12, 2023 and bring a form of personal picture identification with you. Directions to the Annual Meeting available by contacting Investor Relations at uniQure N.V., Paasheuvelweg 25a, 1105BP Amsterdam, the Netherlands, telephone number +1-339-970-7000, email investors@uniQure.com. Failure to comply with these requirements may preclude you from being admitted to the Annual Meeting. |

If Ordinary Shares are held in street name at the close of business on the Record Date, you may vote:

| ● | By Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote by internet or telephone. |

| ● | By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares. |

| ● | In Person at the Meeting. If you attend the meeting, in addition to picture identification, you should bring an account statement or a letter from the record holder indicating that you owned the shares and the number of shares as of the record date, and contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting. Failure to comply with these requirements may preclude you from being admitted to the Annual Meeting. |

4

Unlike our past several meetings conducted pursuant to the Dutch emergency COVID-19 regulations, we will not conduct the 2023 Annual Meeting of 33 1/3%over the Internet via live audio webcast. Please ensure that you vote in advance of the outstanding2023 Annual Meeting by Internet, by telephone or by mail, in accordance with the instructions above. To be sure that your vote will be received in time (and no later than 11:59 p.m. Central European Summer Time on June 12, 2023), please cast your vote by your choice of available means at your earliest convenience. Even if you plan to attend the Annual Meeting, we encourage you to vote your shares by Internet or by telephone.

Can I Change My Vote?

Even if you execute and deliver a proxy, you retain the right to revoke it and to change your vote to attend and vote in person at the 2023 Annual Meeting or any adjournment thereof. If you are a record holder of Ordinary Shares at the close of business on the Record Date, you may change your vote by doing any one of the following:

(1) | Vote over the Internet or by telephone as instructed above. Only your latest Internet or telephone vote is counted. You may not change your vote over the Internet or by telephone after 11:59 p.m., Central European Summer Time on June 12, 2023. |

(2) | You must notify us of your intention to revoke your proxy no later than 12:00 p.m. Central European Summer Time on June 12, 2023. Such revocation may be effected in writing by execution of a subsequently dated proxy, or by a written notice of revocation, sent to the attention of Investor Relations at the address of our principal executive offices set forth above. |

(3) | Attend the Annual Meeting in person and vote as instructed above. |

If your shares are held in street name, you may submit new voting instructions by contacting your broker or other nominee. You may also attend the Annual Meeting in person and vote as instructed above.

Unless so revoked, the shares represented by a proxy, if received in time, will be voted in accordance with the directions given therein.

If the 2023 Annual Meeting is postponed or adjourned for any reason, at any subsequent reconvening of the 2023 Annual Meeting, all proxies will be voted in the same manner as the proxies would have been voted at the original convening of the 2023 Annual Meeting (except for any proxies that have at that time effectively been revoked or withdrawn).

How do I Vote by Proxy

The Ordinary Shares represented by any proxy duly given will be voted at the 2023 Annual Meeting in accordance with the instructions of the Shareholder. You may vote “FOR” or “AGAINST” or “ABSTAIN” from each of the voting proposals.

What Does it Mean to “ABSTAIN” from a Vote?

An “abstention” represents a shareholder’s affirmative choice to decline to vote on a proposal.

What if I Return my Proxy Card but do not Provide Voting Instructions?

If no specific instructions are given, the shares will be voted “FOR” the voting proposals described in this Proxy Statement. In addition, if any other matters come before the 2023 Annual Meeting, the persons named in the accompanying proxy card will vote in accordance with their best judgment with respect to such matters.

If we receive a signed and dated proxy card or receive your instructions by Internet or by telephone and your instructions do not specify how your shares are to be voted, your shares will be voted with the Board’s recommendations.

5

What Happens if I Fail to Vote or Abstain from Voting?

If you do not exercise your vote because you do not submit a properly executed proxy card to the Company, and do not vote by Internet or by Telephone, in accordance with the instructions contained in this Proxy Statement in a timely fashion or by failing to attend the Annual Meeting to vote in person or fail to instruct your broker, bank, trust company or other nominee how to vote on a non-routine matter, it will have no effect on a Proposal. If you mark your proxy or voting instructions expressly to abstain or to cast a “blank vote” for any Proposal, it will also have no effect on such Proposal. If you do not give instructions to your broker, bank, trust company or other nominee, such broker, bank, trust company or other nominee will nevertheless be entitled to vote your shares in its discretion on routine matters and may give or authorize the giving of a proxy to vote the shares in its discretion on such matters.

If My Shares are Held in Street Name by my Broker, Will my Broker Automatically Vote My Shares for Me?

If you hold your shares in street name, your broker, bank, trust company or other nominee cannot vote your shares on non-routine matters, such as the appointment of our directors, without instructions from you. You should therefore instruct your broker, bank, trust company or other nominee as to how to vote your shares, following the directions from your broker, bank, trust company or other nominee provided to you. Please check the voting form used by your broker, bank, trust company or other nominee.

If you do not provide your broker, bank, trust company or other nominee with instructions and your broker, bank, trust company or other nominee submits an unvoted proxy with respect to a proposal that is requireda non-routine matter, this will be considered to be a “broker non-vote” and your shares will not be counted for purposes of determining the presence of a quorum with respect to that proposal. However, your broker, bank, or trust company is entitled to vote shares held for a quorum. “Abstentions” and “broker non-votes,” if any,beneficial owner on routine matters, such as the ratification of the appointment of our independent registered public accounting firm, without instructions from the beneficial owner of those shares, in which case your shares will be counted as present and entitled to votecount for purposes of determining whether a quorum is present forwith respect to that proposal.

Beneficial owners of Ordinary Shares held through a broker, bank, trust company or other nominee may not vote the transaction of businessunderlying shares at the meeting.Annual Meeting, unless they first obtain a signed “legal proxy” from the bank, broker, trust company or other nominee through which you beneficially own your shares.

What Are Broker Non-Votes?

“Broker non-votes” are shares represented at the 20182023 Annual Meeting held by brokers, bankers, or other nominees (i.e., in “street name”) andthat are not voted on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Generally, brokerage firms may vote to ratify the selection of independent auditors and on other “discretionary” or “routine” items. In contrast, brokerage firms may not vote to electappoint directors, because those proposals are considered “non-discretionary” items. Accordingly, if you do not instruct your broker how to vote your shares on “non-discretionary” matters, your broker will not be permitted to vote your shares on these matters. This is a “broker non- vote.”

Methods of Voting

If you were a record holder of Ordinary Shares on May 16, 2018, you may vote as follows:

·By Internet. AccessWhat are the websiteCosts of the Company’s tabulator, Computershare, at: http://www.investorvote.com/QURE, using the voter control number printed on the furnished proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message. If you vote on the Internet, you also may request electronic delivery of future proxy materials.

·By Telephone. Call 1-800-652-8683 toll-free from the U.S., U.S. territories and Canada and follow the instructions on the enclosed proxy card. Your shares will be voted in accordance with your instructions. You must specify how you want your shares voted or your telephone vote cannot be completed. You must have the control number that is included on the proxy card when voting.

·By Mail. Complete and mail a proxy card in the enclosed postage prepaid envelope to the address provided. Your proxy will be voted in accordance with your instructions. If you are mailed or otherwise receive or obtain a proxy card, and you choose to vote by telephone or by Internet, you do not have to return your proxy card.

·In Person at the Meeting. If you attend the 2018 Annual Meeting, be sure to bring a form of personal picture identification with you. You may deliver your completed proxy card in person, or you may vote by completing a ballot, which will be available at the meeting. Directions to the Annual Meeting are available by contacting Investor Relations at , uniQure N.V., Paasheuvelweg 25a, 1105BP Amsterdam, the Netherlands, telephone number +1-339-970-7000, email investors@uniQure.com.

If your Ordinary Shares are held in street name (held for your account by a broker or other nominee) at the close of business Eastern Time on May 16, 2018, you may vote:

·By Internet or By Telephone. You will receive instructions from your broker or other nominee if you are permitted to vote by internet or telephone.

·By Mail. You will receive instructions from your broker or other nominee explaining how to vote your shares.

·In Person at the Meeting. If you attend the meeting, in addition to picture identification, you should bring an account statement or a letter from the record holder indicating that you owned the shares as of the record date, and contact the broker or other nominee who holds your shares to obtain a broker’s proxy card and bring it with you to the meeting.

Board’s Recommendations

The Board recommends a vote:

· Voting Proposal No. 1: “FOR” adoption of the 2017 Dutch statutory annual accounts and treatment of the results.

· Voting Proposal No. 2: “FOR” discharge of the members of the Board.

· Voting Proposal No. 3: “FOR” reelection of Philip Astley-Sparke as a non-executive director.

· Voting Proposal No. 4: “FOR” election of Robert Gut as a non-executive director.

· Voting Proposal No. 5: “FOR” the amendment to the 2014 Restated Plan.

· Voting Proposal No. 6: “FOR” designating the Board as the competent body to issue Ordinary Shares and options and to exclude preemptive rights under the 2014 Restated Plan.

· Voting Proposal No. 7: “FOR” the approval of the employee share purchase plan.

· Voting Proposal No. 8: “FOR” renewing the designation of the Board as the competent body to issue Ordinary Shares and options and to limit or exclude preemptive rights.

· Voting Proposal No. 9: “FOR” reauthorization of the Board to repurchase Ordinary Shares.

· Voting Proposal No. 10: “FOR” reappointment of PricewaterhouseCoopers Accountants N.V. as the Company’s independent registered public accounting firm for the financial year 2018.

Voting by Proxy

The Ordinary Shares represented by any proxy duly given will be voted at the 2018 Annual Meeting in accordance with the instructions of the Shareholder. You may vote “FOR” or “AGAINST” or “ABSTAIN” from each of the proposals. If no specific instructions are given, the shares will be voted “FOR” the voting proposals described in this Proxy Statement. In addition, if any other matters come before the 2018 Annual Meeting, the persons named in the accompanying Proxy Card will vote in accordance with their best judgment with respect to such matters.

Revoking Your Proxy

Even if you execute a proxy, you retain the right to revoke it and to change your vote by notifying us at any time before your proxy is voted. Such revocation may be effected in writing by execution of a subsequently dated proxy, or by a written notice of revocation, sent to the attention of Investor Relations at the address of our principal executive office set forth above, or by your attendance and voting in person at the 2018 Annual Meeting or any

adjournment thereof. Unless so revoked, the shares represented by a proxy, if received in time, will be voted in accordance with the directions given therein.

If the 2018 Annual Meeting is postponed or adjourned for any reason, at any subsequent reconvening of the 2018 Annual Meeting, all proxies will be voted in the same manner as the proxies would have been voted at the original convening of the 2018 Annual Meeting (except for any proxies that have at that time effectively been revoked or withdrawn).

You are requested, regardless of the number of shares you own or your intention to attend the 2018 Annual Meeting, to vote as soon as possible by proxy. You do not need to affix postage to the enclosed reply envelope if you mail it within the United States.

Solicitation of Proxies

Proxies?

The expenses of solicitation of proxies will be paid by the Company. We may solicit proxies by mail, by electronic mail or by phone through agents of the Company. Additionally, the employees of the Company, who will receive no extra compensation therefor, may solicit proxies personally, by telephone, electronic mail, facsimile or mail. The Company will also reimburse banks, brokers or other institutions for their expenses incurred in sending proxies and proxy materials to the beneficial owners of shares held by them.

6

DeliveryWhy Did I Receive a One-Page Notice in The Mail Regarding the Internet Availability of Proxy Materials to HouseholdsInstead Of A Full Set of Proxy Materials as I have in the Past?

Only one copyWe have opted to use the “Notice and Access” method of posting the Company’s 2017proxy materials online instead of mailing printed copies. We believe that this process will provide you with a convenient and quick way to access the proxy materials, including this Proxy Statement and our Annual Report on Form 10-K, (includingand to authorize a proxy to vote your shares, while allowing us to conserve natural resources and reduce the financial statementscosts of printing and schedules thereto) as filed withdistributing the Securities and Exchange Commission (the “SEC”) (the “2017 Annual Report”) and this Proxy Statementproxy materials.

Shareholders will be delivered to an address where two or more Shareholders reside unless we have received contrary instructions from a Shareholder residing at such address. A separate Proxy Card will be delivered to each Shareholder at the shared address.

If you are a Shareholder who lives at a shared address and you would like additionalnot receive paper copies of the 2017 Annual Report,proxy materials unless they request them. Instead, the Proxy Statement,Notice, which will be mailed to our Shareholders of record, provides instructions regarding how you may access or any future annual reportsrequest all of the proxy materials by telephone or proxy statements, please contact Investors Relations, uniQure N.V., Paasheuvelweg 25a, 1105BP Amsterdam, the Netherlands, telephone number +1-339-970-7000, email investors@uniQure.com, and we will promptly mailemail. The Notice also instructs you copies. This Proxy Statement and the 2017 Annual Report are also available at http://www.edocumentview.com/QURE.how to vote your shares online. If you are receiving multiple copies of this Proxy Statement and 2017 Annual Report at your household and wishprefer to receive only one, please contact Investor Relations at the mailing address, phone numbera paper or email address listed above.copy of the proxy materials, you should follow the instructions for requesting such materials printed on the Notice.

Where Can I Find the Voting Results

Results?

The preliminary voting results will be announced at the 20182023 Annual Meeting. The final results will be disclosed in a Current Report on Form 8-K within four business days after the meeting date.

Status as an “emerging growth company”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups (JOBS) Act

7

VOTING PROPOSAL NO. 1

ADOPTION OF THE 2022 DUTCH STATUTORY ANNUAL ACCOUNTS AND TREATMENT OF THE RESULTS

As a public company reporting requirements. These reduced reporting requirements include reduced disclosure about our executive compensation arrangements and no non-binding advisory votes on executive compensation. We will remain an emerging growth company untilwith limited liability (naamloze vennootschap) incorporated under the earlier of (1) the last daylaws of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering in February 2014, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in whichNetherlands, we are deemedrequired by both Dutch law and our Articles of Association to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Contact for Additional Questions

If you hold your shares directly, please contact Investor Relations at uniQure N.V., Paasheuvelweg 25a, 1105BP Amsterdam, the Netherlands, telephone number +1-339-970-7000, email investors@uniQure.com. If your shares are held in street name, please use the contact information provided on your voting instruction form or contact your broker or nominee holder directly.

AGENDA ITEM I—OPENING AND ANNOUNCEMENTS

The Chairman will open the 2018 Annual Meeting and make any announcements.

AGENDA ITEM II —REPORT ON THE FINANCIAL YEAR 2017

This item is for discussion only.

Under this agenda item, the Board will discuss the business and results of operations of the Company as contained inprepare the Dutch statutory annual reportaccounts and submit them to our Shareholders for the year December 31, 2017 (the “2017adoption. Our 2022 Dutch Statutory Annual Report”). Our 2017 Dutch Statutory Annual Report includesstatutory annual accounts include our consolidated financial statements for the year ended December 31, 2017,2022, for the uniQure N.V. group, which are comprised of the consolidated statements of financial position, consolidated statements of profit orand loss and other comprehensive income, consolidated statements of changes in equity and consolidated statements of cash flows with explanatory notes thereto prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, as well as stand-alone Company-only financial statements of uniQure N.V. for the fiscal year ended December 31, 2017,2022, comprising uniQure N.V.’s Company-only statement of financial position and the Company-only statement of profit and loss with explanatory notes thereto prepared in accordance with Book 2 of the Dutch Civil Code (together, “2017the “2022 Dutch Statutory Annual Accounts”), as well as the Report of the Board of Directors..

In accordance with the Dutch Corporate Governance Code, the contents of the corporate governance chapter in the 2017 Dutch Annual Report, including the Company’s compliance with the Dutch Corporate Governance Code, will also be submitted for discussion.

AGENDA ITEM III —EXPLANATION OF THE APPLICATION OF THE REMUNERATION POLICY

This item is for discussion only.

Under this agenda item and in accordance with the Dutch Civil Code, an explanation will be provided on how the Company’s remuneration policy was applied in fiscal year 2017.

VOTING PROPOSAL NO. 1 —ADOPTION OF THE 2017 DUTCH STATUTORY ANNUAL ACCOUNTS

AND TREATMENT OF THE RESULTS

As a public limited liability corporation (namenslooze vennopschaap) incorporated under the laws of the Netherlands, we are required by both Dutch law and our Articles of Association to prepare the Dutch statutory annual accounts and submit them to our shareholders for confirmation and adoption. Our 20172022 Dutch Statutory Annual Accounts differ from the consolidated financial statements contained in our Annual Report on Form 10-K, for the year ended December 31, 2017, that werewhich was prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), and filed with the SEC. The 2017Our 2022 Dutch Statutory Annual Accounts contain some disclosures that are not required under U.S. GAAP and that are therefore not contained in our 2017 Annual Report on Form 10-K.

A copy of our 20172022 Dutch Statutory Annual Accounts is available on our website at www.uniqure.com or may be obtained by contacting Investor Relations at investors@uniQure.com or by telephone numberat +1-339-970-7000.

Due to the international nature of our business and pursuant to a prior shareholder authorization, our 20172022 Dutch Statutory Annual Accounts have been prepared in the English language.

VOTE REQUIRED

The affirmative vote of a majority of our Ordinary Shares present in person or represented by proxy at the 20182023 Annual Meeting and entitled to vote, is required to approve Voting Proposal No. 1. Abstentions and broker non-votes will have no effect on the outcome of this vote.

BOARD RECOMMENDATION

The Board unanimously recommends that shareholders vote “FOR” the adoption of our Dutch Statutory Annual Accounts for the fiscal year ended December 31, 2022.

8

OUR BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ADOPTION OF OUR DUTCH STATUTORY ANNUAL ACCOUNTS FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017.

VOTING PROPOSAL NO. 2— 2

DISCHARGE OF LIABILITY OF THE MEMBERS OF THE BOARD

OF DIRECTORS

At the 20182023 Annual Meeting, as contemplated by Dutch law and as is typical for Dutch registered companies, our Registered Shareholders will be asked to grant discharge of liability of the members of our Board in office for the management and conducted policy during the 20172022 financial year insofar as the exercise of such duties is reflected in the 20172022 Dutch Statutory Annual Accounts and the 2022 Dutch Statutory Board Report or otherwise disclosed toat the 20182023 Annual Meeting.

If our Registered Shareholders approve to grant discharge of liability, the members of our Board will not be liable to our Companyus for actions that such directors took on behalf of our Company in the exercise of their duties in 20172022 and as reflected in the 20172022 Dutch Statutory Annual Accounts and the 2022 Dutch Statutory Board Report or otherwise disclosed to the 20182023 Annual Meeting. Therefore, this release does not apply to matters that were not previously disclosed to our Shareholders. This release also is subject to the provisions of Dutch law relating to liability upon commencement of bankruptcy or other insolvency proceedings.

VOTE REQUIRED

The affirmative vote of a majority of our Ordinary Shares present in person or represented by proxy at the 20182023 Annual Meeting and entitled to vote, is required to approve Voting Proposal No. 2. Abstentions and broker non-votes will have no effect on the outcome of this vote.

BOARD RECOMMENDATION

OUR BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTEThe Board unanimously recommends that shareholders vote “FOR” THE GRANT OF DISCHARGE OF LIABILITY OF THE MEMBERS OF OUR BOARD IN OFFICE DURING THE FISCAL YEAR ENDED DECEMBERthe grant of discharge of liability of the members of the Board in office during the fiscal year ended December 31, 2017 FOR THE MANAGEMENT AND CONDUCTED POLICY DURING OUR FISCAL YEAR ENDED DECEMBER2022 for the management and conducted policy during our fiscal year ended December 31, 2017 INSOFAR AS THE EXERCISE OF SUCH DUTIES IS REFLECTED IN THE DUTCH STATUTORY ANNUAL REPORT OR DISCLOSED TO THE 2018 ANNUAL MEETING.2022 insofar as the exercise of such duties is reflected in the 2022 Dutch Statutory Annual Accounts and the 2022 Dutch Statutory Board Report or otherwise disclosed at the 2023 Annual Meeting

AGENDA ITEM VI

9

VOTING PROPOSAL NO. 3, NO. 4, NO. 5 and NO. 4 — 6

BOARD APPOINTMENTSAPPOINTMENT

The Board is responsible for establishing broad corporate policies and monitoring the overall performance of the Company. It selects the Company’s senior management, delegates authority for the conduct of the Company’s day-to-day operations to those senior managers and monitors their performance. Members of the Board are kept informed of the Company’s business by, among other things, participating in Board and Committee meetings, attending certain meetings with senior and byother management of the Company, and reviewing analyses and reports provided to them.

The Board is currently made up of sevennine directors. The termterms of office of onefor four non-executive director, Philip Astley-Sparke, isdirectors, Madhavan Balachandran, Jack Kaye, Leonard Post, and Jeremy Springhorn, are scheduled to expire on the date of the 2018 annual meeting (the “20182023 Annual Meeting”);Meeting. The terms of office of three non-executive directors, Rachelle Jacques, David Meek, and Paula Soteropoulos, are scheduled to expire on the termdate of the 2024 Annual General Meeting of Shareholders. The terms of office of one executive director, Matthew Kapusta isand one non-executive director, Robert Gut, are scheduled to expire on the date of the 2019 annual meeting (the “20192025 Annual Meeting”); the term of office of four non-executive directors, Jack Kaye, David Schaffer, Madhavan Balachandran and Jeremy Springhorn, is scheduled to expire on the dateMeeting of the 2020 annual meeting (the “2020 Annual Meeting”); and the termShareholders. Under our Articles of office of one non-executive director, Paula Soteropoulos, is scheduled to expire on the date of the 2021 annual meeting (the “2021 Annual Meeting”). AllAssociation, all directors will hold office for a maximum term of four years, or until their earlier death, resignation, removal or disqualification. Ouryears. However, the current practice of the Board is to nominate all directors, both executive and non-executive, for terms of office of three years. The Board has implemented staggered terms to provide for a retirement schedule as required by our Articles of Association do not require the terms of the directors be staggered.

Association.

The Board has nominated Philip Astley-Sparkeeach of Madhavan Balachandran, Jack Kaye, Leonard Post and Jeremy Springhorn for reelectionreappointment to the Board, each to serve as a non-executive director until the 2021 annual general meeting2026 Annual General Meeting of shareholdersShareholders or until his earlier death, resignation, removalsuspension, or disqualification. The Board has also nominated Robert Gut for electiondismissal. Each of Messrs. Balachandran, Kaye, Post and Springhorn have consented to the Board,being named in this Proxy Statement and to continue to serve, until the 2021 annual general meeting of shareholders or until his earlier death, resignation, removal or disqualification.

The Board of Directors recommendsif appointed, as a vote “FOR” the election of eachmember of the nominees listed below.

Board.

The names, positionsname, position with the Company and agesage as of the Record Date of the individualseach individual who areis our nomineesnominee for electionappointment as directors are:a director is:

| | | | | | |

Name |

| Age |

| Position |

| Director |

Madhavan Balachandran | | 72 | | Non-Executive Director | | 2017 |

Jack Kaye | | 79 | | Non-Executive Director | | 2016 |

Leonard Post | | 70 | | Non-Executive Director | | 2020 |

Jeremy Springhorn | | 60 | | Non-Executive Director | | 2017 |

Name |

| Age |

| Position |

| Director Since |

Philip Astley-Sparke |

| 46 |

| Chairman, Non-Executive Director |

| 2015 |

Robert Gut, M.D., Ph.D. |

| 54 |

| N/A |

| N/A |

The Board may nominate an additional nominee between the date of the filing of this preliminary proxy and the date of the filing of the definitive proxy. Should the Board do so, the Proxy Statement will be updated with information regarding the nominee and their anticipated role on the Board in the event the 2018 Annual Meeting approves his or her appointment.

PHILIP ASTLEY-SPARKE.MADHAVAN BALACHANDRAN. Philip Astley-Sparke, age 46,Mr. Balachandran has served as a member of our Board since June 2015 and as chairman since 2016. He was previously president of uniQure Inc. from January 2013 until February 2015 and was responsible for building uniQure’s U.S. infrastructure.September 2017. Mr. Astley-Sparke is currently Executive Chairman and co-founder of Replimune Group, Inc., a company developing second-generation oncolytic vaccines. Mr. Astley-Sparke served as vice president and general manager at Amgen, Inc. (NASDAQ: AMGEN), a biopharmaceutical company, until December 2011, following Amgen’s acquisition of BioVex Group, Inc., a biotechnology company, in March 2011. Mr. Astley-Sparke had been President and Chief Executive Officer of BioVex Group, which developed the first oncolytic vaccine to be approved in the western world following the approval of Imlygic in 2015. He oversaw the company’s relocation to the U.S. from the UK in 2005. Prior to BioVex, Mr. Astley-Sparke was a healthcare investment banker at Chase H&Q/Robert Fleming and qualified as a Chartered Accountant with Arthur Andersen in London. Mr Astley-SparkeBalachandran has been a venture partner at Forbion Capital Partners, a life sciences venture capital fund,director of Catalent (NYSE: CTLT) since May 2017. Mr. Balachandran was Executive Vice President, Operations of Amgen Inc. (“Amgen”), a global biotechnology company, from August 2012 until July 2016 and servesretired as Chairmanan Executive Vice President in January 2017. Mr. Balachandran joined Amgen in 1997 as Associate Director, Engineering. He became Director, Engineering in 1998, and, from 1999 to 2001, he held the position of Senior Director, Engineering and Operations Services before moving to the Boardposition of Oxyrane,Vice President, Information Systems from 2001 to 2002. Thereafter, Mr. Balachandran was Vice President, Puerto Rico Operations from May 2002 to February 2007. From February 2007 to October 2007, Mr. Balachandran was Vice President, Site Operations, and from October 2007 to August 2012, he held the position of Senior Vice President, Manufacturing. Prior to his tenure at Amgen, Mr. Balachandran held leadership positions at Copley Pharmaceuticals, now a biotechnology company.part of Teva Pharmaceuticals Industries Ltd., and Burroughs Wellcome Company, a predecessor before mergers of GlaxoSmithKline plc. Mr. Balachandran holds a Master of Science degree in Chemical Engineering from The State University of New York at Buffalo, a Bachelor’s degree in Chemical Engineering from the Indian Institute of Technology, Bombay, and an MBA from East Carolina University. We believe that Mr. Astley-SparkeBalachandran is qualified to serve as a non-executive directorNon-Executive Director due to his expertiseextensive experience in the biotechnology industry.

10

JACK KAYE. Mr. Kaye has served as a member of our Board since 2016. Mr. Kaye is currently a member of the Compensation Committee of Dyadic International, Inc. (OTC: DYAI), and serves as chairman of the Audit Committee and as a director of DiaCarta Ltd., a private company. He has also served as Chairman of the Audit Committee of Keryx Biopharmaceuticals, Inc. (Nasdaq: KERX) from 2006 to 2016. Mr. Kaye began his career at Deloitte LLP (“Deloitte”), an international accounting, tax, and consulting firm, in 1970, and was a partner in the firm from 1978 until May 2006. At Deloitte, he was responsible for servicing a diverse client base of public and private, global, and domestic companies in a variety of industries. Mr. Kaye has extensive experience consulting with clients on accounting and reporting matters, private and public debt financings, SEC rules and regulations, corporate governance, and Sarbanes-Oxley matters. Prior to retiring, Mr. Kaye served as Partner-in-Charge of Deloitte’s Tri-State Core Client practice, a position he held for more than 20 years. Mr. Kaye has a Bachelor of Business Administration from Baruch College and is a Certified Public Accountant. We believe that Mr. Kaye is qualified to serve as a Non-Executive Director due to his extensive accounting and financial experience.

LEONARD POST, PH.D. Dr. Post has over 35 years of experience in the pharmaceutical industry where he has held various global executive positions and has extensive experience in research and development of product candidates. Since July 2016, Dr. Post has served as Chief Scientific Officer of Vivace Therapeutics, an oncology company working on small molecules targeting the hippo pathway and is also Chief Scientific Officer of its sister company Virtuoso Therapeutics, a company working on bispecific antibodies for oncology. From February 2010 until June 2016, Dr. Post worked at BioMarin (Nasdaq: BMRN), in various positions including Chief Scientific Officer. During that time, he oversaw the initiation of BioMarin’s first gene therapy project for hemophilia A. Prior to that, Dr. Post served as Chief Scientific Officer of LEAD Therapeutics, Senior Vice President of Research & Development at Onyx Pharmaceuticals, and Vice President of Discovery Research at Parke-Davis Pharmaceuticals. He is also currently an advisor to Canaan Partners. Dr. Post is a virologist by training and did early work on engineering of herpes simplex virus as a postdoctoral fellow. He has a Bachelor of Science degree in Chemistry from the University of Michigan, and a Doctorate degree in Biochemistry from the University of Wisconsin. We believe Dr. Post is qualified to serve as a Non-Executive Director due to his extensive experience in the biotechnology industry.

ROBERT GUT, M.D., PH.D.JEREMY SPRINGHORN, Ph.D. Dr. Robert Gut, age 54,Springhorn has nearly 20 years of experience in the biopharmaceutical industry, leading clinical development and medical affairs initiatives in different therapeutic areas: endocrinology, hematology, inflammation, osteoporosis and women’s health. Dr. Gut was appointed the Chief Medical Officer of Versartis, Inc. in September 2017. Prior to joining Versartis, Dr. Gut served as Vice President, Global Medical Affairs and Development at Radius Health. Over the past decade, his contributions in regulatory activities have helped achieve six U.S. Food and Drug Administration (FDA) product approvals and three new product indications. He has supported the launch of nine new products, overseeing medical affairs activities, including medical science liaison team building, health economics and outcomes research, and market access. He has also served as a member of the Advisory Committees for Reproductive Health Drugs and Drug Safety and Risk Management for the FDA’s Center for Drug Evaluation and Research. For the majorityour Board since September 2017. Since April 2021, Dr. Springhorn has been Chief Executive Officer of Nido Biosciences, a developer of small molecule therapeutics. Prior to taking his career,position at Nido, Dr. GutSpringhorn was Chief Business Officer of Syros Pharmaceuticals, Inc. (Nasdaq: SYRS) from November 2017 until April 2021. Prior to taking his position at Syros, Dr. Springhorn served as Partner, Corporate Development at Flagship Pioneering from March 2015 until June 2017 where he worked with VentureLabs in helping companies in various strategic and corporate development capacities, creating next generation startups, and working with Flagship’s Corporate Limited Partners. Prior to joining Flagship, Dr. Springhorn was one of the original scientists at Alexion Pharmaceuticals, Inc. (Nasdaq: ALXN) and was one of the original inventors of the drug Soliris®. At Alexion Pharmaceuticals, Dr. Springhorn was Vice President Clinicalof Corporate Strategy and Business Development & Medical Affairsfrom 2006 until March 2015. Dr. Springhorn started at Novo Nordisk Inc. He headed the company’s U.S. Biopharm Medical organization with leading productsAlexion in endocrinology, hemophilia and women’s health. He is a recognized author of more than 90 publications and is a member of numerous professional organizations, including The Endocrine Society (ENDO).1992 where he served in various leadership roles in R&D before switching to Business Development in 2006. Prior to 1992, Dr. GutSpringhorn received his Doctor of Medicine degreePh.D. from theLouisiana State University Medical University of Lublin,Center in New Orleans and his Doctorate degreeBA from Lublin Institute of Medicine, Poland. He has attended postgraduate programs and trainings at Wharton, Stanford and Harvard Business School.Colby College. We believe that Dr. GutSpringhorn is qualified to serve as a non-executive directorNon-Executive Director due to his expertise andextensive experience in the biotechnology industry.

Dr. Gut has not previously served as a director or executive officer ofIf reappointed, the Company.

If elected, the termsterm of office for Mr. Astley-Sparkeeach of Messrs. Balachandran, Kaye, Post and Dr. GutSpringhorn will expire on the date of the 2021 annual general meeting2026 Annual General Meeting of shareholders.

Based upon information requested from and provided by each nominee for director concerning their background, employment and affiliations, including family relationships, our Board has determined that each of Mr. Astley-Sparke and Dr. Gut has no relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is independent within the meaning of the director independence standards of the Nasdaq rules and the SEC.

If the 2018 Annual Meeting approves the appointment of Dr. GutShareholders. Pursuant to the Board,Company’s Articles of Association, the Board plans to appoint hima chair of the Board and any new committee members at the first meeting of the Board following the 2023 Annual Meeting, which is currently scheduled for June 13, 2023.

We currently expect that: (i) Mr. Kaye will continue to serve onas a member of our Compensation Committee and as the chair of our Audit Committee, (ii) Mr. Balachandran will continue to serve as the chair of our Compensation Committee, (iii) Dr. Post will continue to serve as the chair of our Research and Development Committee, and (iv) Dr. Springhorn will continue to serve as a member of our Audit Committee and as the chair of of our Nominating and Governance Committee.

11

For information as to the Ordinary Shares held by Mr. Astley-Sparke,Madhavan Balachandran, Jack Kaye, Leonard Post, and Jeremy Springhorn, see “Security Ownership of Certain Beneficial Owners and Management.” Dr. Gut does not hold Ordinary Shares or options to purchase Ordinary Shares of the Company.

There are no arrangements or understandings between the nominees, directors or executive officersofficer and any other person pursuant to which our nominees,nominee, directors or executive officersofficer have been selected for their respective positions. However, the Company has entered into indemnification agreements with its existing non-executive directors pursuant to which the Company agrees to indemnify such directors in certain circumstances.

VOTE REQUIRED

Under our Articles of Association and consistent with Dutch law, executive directors and non-executive directors are appointed by the general meeting from a binding nomination by the non-executive directors. The proposed candidate specified in the binding nomination shall be appointed, provided that the requisite quorum is represented by a proxy at the 2023 Annual Meeting, unless the nomination is overruled by the general meeting, which resolution requires at least a two-third majority of the votes cast at the 2023 Annual Meeting, provided that such majority represents at least half of the issued share capital. Each Ordinary Share confers the right to cast one vote at the 2023 Annual Meeting. Abstentions, “blank votes”, “broker non-votes” and invalid votes are not considered votes cast.

BOARD RECOMMENDATION

The Board unanimously recommends that you vote “FOR” each of the nominees for Director

12

VOTING PROPOSAL NO. 7

RENEW THE DESIGNATION OF THE BOARD AS THE COMPETENT BODY TO ISSUE ORDINARY SHARES AND GRANT RIGHTS TO SUBSCRIBE FOR ORDINARY SHARES

At the 2023 Annual Meeting, as contemplated by Dutch law and as is typical for Dutch registered companies, our Shareholders will be asked to renew the designation of our Board as the competent body to issue Ordinary Shares and to grant rights to subscribe for Ordinary Shares up to a maximum of (i) our authorized share capital in the event of an underwritten public offering, or (ii) 19.9% of our aggregate issued share capital at the time of issuance in connection with any other single issuance (or series of related issuances), for a term of 18 months with effect from the date of the 2023 Annual Meeting.

Our current authorized share capital consists of eighty million (80,000,000) Ordinary Shares, each with a nominal value per share of €0.05. Under Dutch law and our Articles of Association, we are required to seek the approval of our Shareholders each time we wish to issue shares of our authorized share capital unless our Shareholders have authorized our Board to issue shares. This authorization may not continue for more than five years but may be given on a rolling basis. We currently have authorization from our Shareholders to issue Ordinary Shares, or grant rights to subscribe for Ordinary Shares, up to a maximum of (i) our authorized share capital in the event of an underwritten public offering or (ii) 19.9% of our aggregate issued share capital at the time of issuance in connection with any other single issuance (or series of related issuances). This existing authorization expires on December 14, 2023, and we believe it is common practice for Dutch companies to seek to renew this authorization annually on a rolling basis. The approval of this voting proposal will maintain our flexibility to allow our Board to issue Ordinary Shares and to grant rights to subscribe for Ordinary Shares without the delay and expense of calling extraordinary general meetings of shareholders. The designation can be used for all purposes, including any issuance under our employee share purchase plan, subject to statutory limitations, and except for awards granted under the Company’s 2014 Share Incentive Plan, as amended and restated.

We also currently issue Ordinary Shares from our authorized share capital to satisfy our obligations under awards granted under our equity compensation plans, and the Shareholders separately authorized such plans. Other than ordinary share issuances in connection with our equity compensation plans (including plans for inducement grants to newly hired employees), our employee share purchase plan, and any sales deemed to be “at-the-market offerings” pursuant to our supplemental prospectus filed on March 2, 2021 with the SEC, we do not have any specific plans, proposals, or arrangements to issue any of our authorized Ordinary Shares for any purpose. However, in the ordinary course of our business, our Board may determine from time to time that the issuance of authorized and unissued shares is in the best interests of our Company, including in connection with equity compensation or future acquisitions or financings.

This authority to issue shares is similar to that afforded under state law to the boards of directors of public companies domiciled in the United States. Management believes that retaining the flexibility to allow our Board to issue our Ordinary Shares for acquisitions, financings, or other business purposes in a timely manner without first obtaining specific shareholder approval is important to our continued growth. Furthermore, our Ordinary Shares are listed on the Nasdaq Global Select Market, and the issuance of additional shares will remain subject to Nasdaq rules. For example, Nasdaq Listing Rule 5635(d) requires shareholder approval for the issuance of shares in a private placement of more than 20% of the shares outstanding, with several exceptions.

If our Shareholders do not renew the designation of our Board as the competent body to issue Ordinary Shares and to grant rights to subscribe for Ordinary Shares, then the previous authorization would remain in place, and our Board would continue to retain authority to issue Ordinary Shares and to grant rights to subscribe for Ordinary Shares pursuant to that authorization until it expires on December 14, 2023.

13

VOTE REQUIRED

The affirmative vote of a majority of our Ordinary Shares present in person or represented by proxy at the 20182023 Annual Meeting and entitled to vote, is required to elect each director nominee. Each proposed non-executive director appointment is consideredapprove Voting Proposal No. 7. Abstentions and broker non-votes will have no effect on the outcome of this vote.

BOARD RECOMMENDATION

The Board unanimously recommends that Shareholders vote “FOR” the renewal of the authority of the Board to issue our Ordinary Shares and grant rights to subscribe for our Ordinary Shares up to a separate voting item under Dutch law.maximum of (i) our authorized share capital in the event of an underwritten public offering, or (ii) 19.9% of our aggregate issued share capital at the time of issuance in connection with any other single issuance (or series of related issuances), for a term of 18 months with effect from the date of the 2023 Annual Meeting.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THESE NOMINEES FOR DIRECTOR.

14

AGENDA ITEM VIITable of Contents

VOTING PROPOSAL NO. 5 —8

REAUTHORIZE THE BOARD TO EXCLUDE OR LIMIT PREEMPTIVE

RIGHTS UPON THE ISSUANCE OF ORDINARY SHARES AND GRANTING OF RIGHTS TO

SUBSCRIBE FOR ORDINARY SHARES

Under Dutch law, holders of our Ordinary Shares would have a pro rata pre-emptive right of subscription to any of our Ordinary Shares issued for cash. A pre-emptive right of subscription is the right of our current Shareholders to maintain their percentage ownership of our Ordinary Shares by buying a proportional number of any new Ordinary Shares that we issue. However, Dutch law and our Articles of Association permit our Shareholders to authorize our Board to exclude or limit these pre-emptive rights. This authorization may not continue for more than five years, but it may be given on a rolling basis. We currently have authorization from our Shareholders to exclude or limit these pre-emptive rights, which authorization expires on December 14, 2023, and it is common practice for Dutch companies to seek to renew this authorization annually on a rolling basis.